Commissioners Court Notes

Please note: All agenda items are considered PASSED unless indicated otherwise.

OPEN SESSION:

PUBLIC HEARING:

1. Receive public input regarding the tax abatement request by Tyler Hotel Partners, LP (Valencia Hotel).

Comments:

No participation from the public.

COURT ORDER

COMMISSIONERS COURT

2. Consider and take necessary action to approve a tax abatement agreement with Tyler Hotel Partners LP, pursuant to Texas Tax Code, Chapter 312, and authorize the county judge to sign all related documentation.

Comments:

As your Smith County Commissioner for Precinct 1, I proudly voted NO today on the proposed 50% property tax abatement under Chapter 312 for The Blackstone boutique hotel in downtown Tyler.

This deal would have the county forfeiting about $37,000 a year in property taxes for 10 years—totaling roughly $370,000—from hardworking taxpayers. All to help secure financing for a private project. In return? Maybe $10,000 in sales tax revenue—if the hotel hits 58% occupancy. Even under good conditions, that doesn’t come close to replacing what’s being given up – especially when you consider the added cost of visitors on law enforcement, EMS and road wear. It is estimated that the 22,000 visitors that the hotel may see in a year will cost $110,000 in city and county services. If the county bears 30% of that cost, that’s $33,000 in county services. The juice isn’t worth the squeeze here.

No Abatement=No Financing

The tax abatement was necessary for the hotel to obtain financing from their bank for the project. Why? Because without the tax cut, the project’s cash flows look too shaky—the bank sees it as a high-risk bet in our mid-sized market. But suddenly, it’s not too risky for our taxpayers to shoulder the extra burdens from all those visitors? Just like the banks protect their money from risk, your County Judge and Commissioners are supposed to protect yours.

Tax abatements like this shift the burden straight onto YOU, the taxpayers. How does a downtown boutique hotel fix our rural roads, boost public safety, or help John and Jane Taxpayer out in the county? It doesn’t. Government shouldn’t be picking winners and losers with your money.

Are You Really A Republican?

A YES vote directly contradicts core Republican Party of Texas principles and platform planks that I fight for every day, like:

- Plank #78: No corporate welfare. We oppose subsidies and special tax breaks for favored companies.

- Principle #9: Free enterprise unencumbered by government interference or subsidies.

Groups like Texas Public Policy Foundation and Texans for Fiscal Responsibility call these Chapter 312 deals exactly what they are: corporate welfare.

True free markets don’t need government handouts to succeed.

Sadly, I doubt many of my colleagues have even read the Republican Party of Texas Platform, Legislative Priorities, or Rules—they might not know they exist. I do. I didn’t just pay a fee to get on the ballot; I live by what YOU, the grassroots Republican voters, decided at Convention in the 2024 TX GOP Platform.

Today’s approval may even qualify as a censurable offense under Rule 44, for opposing our party’s core principles. It counts toward the three required for formal censure by a County.

My NO vote stands for limited government, fair competition, no cronyism, and protecting YOU from favoritism for the connected few.

Next time you’re talking to “Republican” candidates running for office, ask them: Have you actually READ the Texas GOP Platform, Priorities, and Rules?

The platform isn’t optional—it’s the foundation of what defines us as Texas Republicans, decided by YOU at Convention.

We need leaders who actually know and uphold the principles grassroots voters expect, not just those who simply buy their way onto the ballot.

The Commissioners Court voted 4-1 to approve the tax abatement request, with your Commissioner casting the sole “no” vote. As always, I’m here to discuss this or any other Court action with you—feel free to reach out!

PRESENTATION

3. Consider and discuss a presentation on Road Bond Project by Grassroots America, Tom Fabry.

Comments:

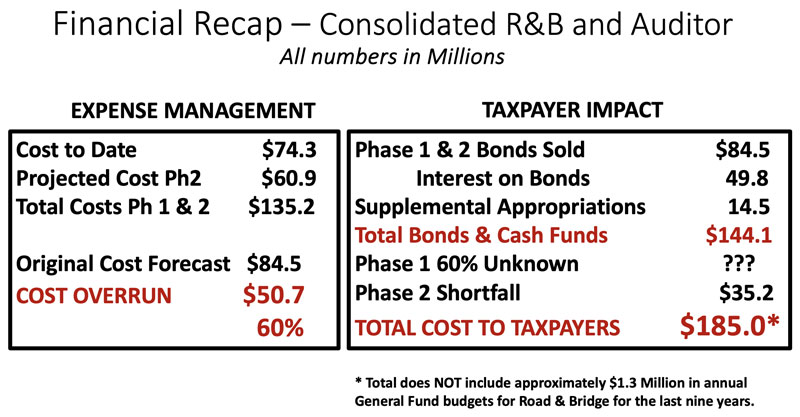

We reviewed a presentation delivered by Grassroots America – We the People PAC titled “Smith County Road Bonds – Independent Assessment: Road Bond Deliverables, Timelines and Financials.”Below is my summary of the key findings from this independent assessment.

Overview

- The presentation critically evaluated the county’s Road Bond Program, highlighting significant delays, incomplete deliverables, and substantial cost overruns.

- It is based the county’s own data, including the Road & Bridge Department’s presentation from March 11, 2025.

GAWTP Findings

Project Timeline and Delivery Shortfalls

- The program, originally planned as a 6-year initiative based on a 2015 engineering assessment, is now in its 9th year.

- Road conditions have worsened due to accelerated deterioration and intensified traffic patterns.

- Phase 1 Progress:

- Approved plan included 259 project segments.

- Only 62 segments completed from the Phase 1 list.

- Additional: 11 from Phase 2 list and 25 not on either approved list.

- Total completed with Phase 1 funds: 98 segments (40% of planned).

- Unfinished Phase 1 segments: 197.

- Duplicates were identified in the R&B list.

- No clear timeline or funding source identified to complete the remaining committed roads.

Financial Summary and Overruns

- Original bond issuance (Phases 1 & 2): $84.5 million.

- Total funds available (bonds + interest + supplemental appropriations): $144.1 million.

- Costs to date: $74.3 million.

- Projected additional cost for Phase 2: $60.9 million.

- Total projected cost (Phases 1 & 2): $135.2 million.

- Cost overrun: $50.7 million (60% over original forecast).

- Phase 2 shortfall: $35.2 million.

- Total taxpayer exposure: Approximately $185 million in sunk costs

- Additional issue noted: $7 million discrepancy between summary and detailed reports (March 11, 2025).

Recommendation from the Presentation

- Grassroots strongly advocated for an independent forensic and compliance audit, citing:

- Significant under-delivery on voter-approved commitments.

- Poor expense management and lack of accountability.

- Material impact on taxpayers.

This assessment raises serious concerns about the management and execution of the Road Bond Program.

In court last week, there was some confusion about when in Texas, the law gives the County the power to hire an outside, independent accountant to audit any part of county finances whenever we think it’s a good idea.

There are two main ways we can do this:

- The “emergency” way (harder and rarer) This requires strong reasons — like suspicion of missing money or serious mistakes. It involves a formal resolution, public newspaper notice, waiting until the next meeting, and everyone on the court agreeing. Almost never used unless something really bad is suspected.

- The easy “public interest” way (the one that applies here) This is from Texas Local Government Code § 115.031(i). All the court must do is say: “We believe an independent audit would best serve the public interest.”

That’s it. No suspicion of wrongdoing needed. No public notice required. No waiting for the next meeting. We can vote at any regular Commissioners Court meeting to order the audit and hire an outside firm to do it.

We heard the full presentation from Grassroots America and listened to everyone who spoke during public comment. A lot of you are understandably upset about the delays, rising costs, and lack of clear information—and I take those concerns seriously. Like you, I am a taxpayer of Smith County.

We didn’t vote to launch a full independent forensic audit right then, but we did take solid next steps. We asked our staff—working with the Purchasing Department, County Auditor, and Road & Bridge team—to put together a clear cost estimate and scope for an independent audit and look into better ways to show progress publicly.

That information will come back to us as an agenda item at an upcoming regular meeting, probably in January. We’ll discuss it openly, hear more from the public, and then vote on the best way forward. I’m committed to getting this resolved responsibly and transparently. Please keep coming to meetings, speaking up, or reaching out to me directly—your voice matters. Thank you for caring about Smith County.

Micro-Managing or Basic Accountability?

I rarely respond to public comments in my reports, but this one stood out as particularly significant. Former Commissioner Pam Frederick shared her perspective during the public comment period, and I felt it required a rebuttal due to the clear differences in our views and ideologies. The issue was important enough that I addressed it directly in a post on my official Elected Official Facebook page.

If you’re not already following my page, you’re missing out on timely updates from the county and real-time information about what’s happening beyond our weekly Commissioners Court meetings.

Click the link below to get to my page and then click the “Follow” button:

https://www.facebook.com/christinaforsmithcounty

Micro-Managing or Basic Accountability?

As a Smith County Commissioner, I respectfully disagree with former Commissioner Pam Frederick’s suggestion during public comment that our role is simply to trust the “experienced and professional people that know their job” and avoid what she called “micro-managing” the skilled professionals serving our county.

The job of a Commissioner is not blind trust—it’s responsible oversight. We have a clear fiduciary duty to protect taxpayer dollars, which means actively monitoring how bond funds and department budgets are spent, tracking progress against promises made to voters, and holding staff accountable when projects fall years behind schedule and costs balloon.

The fact that we’re now in year nine of a six-year road bond program—with significant overruns and unfinished commitments—didn’t happen because Commissioners were overseeing too closely. It happened, in part, because previous Courts, including the one Mrs. Frederick served on, did not require regular, transparent updates from the County Engineer on Phase 1 and Phase 2 progress. There were no consistent quarterly reports, no routine reconciliation of expenditures against deliverables, and insufficient performance measures to ensure voter-approved bonds were delivering results on time and on budget.

Good stewardship isn’t micro-management—it’s basic accountability. It’s asking tough questions, demanding clear data, and making sure the professionals we hire are meeting the goals we set with public money.

I believe this difference in philosophy—whether commissioners should provide active oversight or largely defer without close review—may well explain why voters chose not to return Ms. Frederick to office in the 2024 primary. The people of Smith County expect their elected officials to watch over their tax dollars carefully, not just trust that everything is being handled properly behind closed doors. At the end of the day, the ultimate responsibility for the success or failure of this county rests squarely on the Commissioners Court—we answer directly to the voters, and under the Texas Constitution and state law, we have a clear duty to oversee the county budget, set the tax rate, approve expenditures, and ensure taxpayer funds are spent wisely and legally. That’s the standard I’ll continue to uphold.

COURT ORDERS

COMMISSIONERS COURT

4. Consider and take necessary action to approve a budget request in the total amount of $5,000 from the Smith County Historical Commission for the replacement of two historic subject markers that were removed/destroyed.

Comments:

The Smith County Historical Commission received no funding allocation during the recent budget cycle.

Since this is a new commission, I recommended approving $2,500—rather than the $5,000 requested—to cover the cost of one historical marker. This would help them get started while encouraging them to raise donations for the second marker.

Providing county funds as a donation is not a core function of county government. Taxpayer dollars should not be used this way—citizens should decide for themselves where to direct their charitable contributions.

I shouldn’t ask someone to do anything I’m not willing to do myself. To lead by example and help them meet their need for the second marker, I’d like to graciously ask you to consider skipping one coffee stop or packing a lunch this week to make a small donation to the Smith County Historical Commission.

If 200 or more people from my email list—who are passionate about preserving Smith County’s history—each donate $10–$15 directly to the Smith County Historical Commission, that would fully meet their current request without using taxpayer funds.

If you are interested in the work of the commission or would like to volunteer to help them put together a fundraiser, you can visit their website or email them at smith.co.historical.commission@gmail.com.

5. Consider and take necessary action to approve the FY 2026 Contract for Legal Services for Smith County Court Mental Health Patients with Richard Patteson, in the budgeted amount of $40,020.00, plus additional as needed costs for Out-of-County patients and jail based forced psychoactive medication proceedings and authorize the county judge to sign all related documentation.

Comments:

Similar to our contracts for indigent defense attorneys, Smith County also contracts with outside legal counsel to represent patients in mental health commitment proceedings.

This mental health legal services contract should have been renewed at the same time as the indigent defense contracts, but our Civil District Attorney, Thomas Wilson, informed us that it was inadvertently overlooked.

We are now bringing forward the renewal for the period of October 1, 2025, through September 30, 2026. The contract amount is $40,020 and is already included in the approved budget.

6. Consider and take necessary action to designate Commissioners to serve as primary point of contact for specific departments under the control or oversight of the Commissioners Court, effective January 1, 2026.

Comments:

Each year, the Commissioners are assigned as Liaisons for a group of departments. For 2026, I have been assigned to:

- Road and Bridge

- Pre-Trial Release

- Judicial Compliance/Collections

FIRE MARSHAL’S OFFICE/ EMERGENCY MANAGEMENT

7. Consider and take necessary action to approve the updated Emergency Support Function 3 Public Works and Engineering/Road and Bridge Annex and authorize the county judge to sign all related documentation.

Comments:

Our Smith County Emergency Management Coordinator, Brandon Moore, has a vital role in keeping us all safe. He works closely with our various county departments, first responders, and partner agencies to develop and regularly update our comprehensive emergency operations plans—so we’re as prepared as possible when disasters strike.

In line with that important work, the Commissioners Court recently approved an update to Emergency Support Function 3 (ESF-3): Public Works and Engineering/Road and Bridge Annex.

This updated annex clearly outlines the coordinated roles and procedures for supporting critical infrastructure during emergencies. That includes things like debris removal, clearing roads, making emergency repairs to public facilities, and conducting engineering assessments—primarily through our dedicated Smith County Road and Bridge team.

These improvements will help ensure quicker, more efficient responses to storms, floods, or any other events that affect our roads, bridges, and essential public works—ultimately protecting you, the taxpayers, and our community. I’m grateful for Brandon’s leadership in this area and proud of the steps we’re taking to strengthen our preparedness.

PURCHASING

8. Consider and take necessary action to transfer a county-owned 2016 Chevrolet Silverado from the Purchasing Department to the Facility Services Department and two 2013 Chevrolet Tahoes from surplus to the Purchasing Department and authorize the county judge to sign all related documentation.

Comments:

We recently approved an inter-departmental vehicle transfer to better meet the needs of our county teams while making efficient use of existing resources.

The Facility Maintenance Department added a new groundskeeper position in the FY2026 budget, and this role requires a dedicated county vehicle. The Purchasing Department currently has a 2016 Chevrolet Silverado that is well-suited for this purpose.

At the same time, the Purchasing Department is budgeted for two vehicles: one primary vehicle for transporting surplus property and one “floater” to loan out to other departments when their vehicles are down for repairs. Right now, Purchasing only has the one Silverado, which limits their ability to serve other departments effectively.

To address both needs without purchasing new vehicles, we transferred:

- The 2016 Chevrolet Silverado from the Purchasing Department to the Facility Maintenance Department for the new groundskeeper.

- Two 2013 Chevrolet Tahoes—recently turned in by the Juvenile Department and held in surplus—directly to the Purchasing Department.

This straightforward swap ensures both departments have the vehicles they need to do their jobs efficiently. Both Purchasing and Facility Maintenance have sufficient funds budgeted for ongoing insurance and maintenance costs. For reference, the annual county insurance premium for each of these vehicles is $286.

I’m glad we could handle this internally—it’s a smart, taxpayer-friendly way to keep our operations running smoothly without unnecessary spending.

SHERIFF’S OFFICE

9. Consider and take necessary action to approve the 2025 Federal Equitable Sharing Agreement and Certification for the Smith County Sheriff’s Office and authorize the county judge to sign all related documentation.

Comments:

The Smith County Sheriff’s Office participates in federal asset forfeiture programs through the Department of Justice and Department of the Treasury. When our deputies assist federal agencies in investigations—primarily drug-related cases—a portion of seized cash or property proceeds can be shared back with the Sheriff’s Office through the Equitable Sharing Program.

These funds are held in separate federal accounts and can only be used for specific law-enforcement purposes.

Here’s a quick breakdown of the most recent annual certification report (for FY ending September 30, 2025):

Department of Justice Funds

- Beginning balance: $481,971.17

- Funds received from forfeitures: $0.00

- Other income: $0.00

- Interest earned: $15,068.20

- Total funds received: $15,068.20

- Funds spent: $0.00

- Ending balance: $497,039.37

Department of Treasury Funds

- Beginning balance: $36,954.66

- Funds received from forfeitures: $0.00

- Other income: $0.00

- Interest earned: $1,494.88

- Total funds received: $1,494.88

- Funds spent: $0.00

- Ending balance: $38,449.54

No shared funds were spent during this reporting period across any allowable categories (such as training, equipment, investigative support, or public safety initiatives).

10. Consider and take necessary action to accept the grant award for the Office of the Governor Public Safety Office Bullet-Resistant Components for Law Enforcement Vehicles, FY 2026 grant and authorize the county judge to sign all related documentation.

Comments:

Per the Auditor’s request, we passed on this item.

ROAD AND BRIDGE

11. Consider and take necessary action on variance request from the Smith County Subdivision Regulations for the Blaire Lake Addition, Unit 1 Subdivision from the Homeowners Association, The Blaire Lake Addition Residential Community, Inc.

Comments:

We approved a variance request for the landscaped island at the main entrance to the Blaire Lake Addition, a new residential subdivision being developed in the Tyler area of Smith County. The ongoing responsibility of landscaping upkeep, irrigation, lighting, and any repairs to the island falls entirely to the Blaire Lake Homeowners’ Association (HOA). This is a common arrangement for private subdivision amenities: it keeps taxpayer dollars focused on public roads and infrastructure while allowing neighborhoods to maintain their unique character through HOA fees.

12. Consider and take necessary action to accept the roadways of Blaire Lake Addition, Unit One into the Smith County Road Maintenance System and authorize the county judge to sign all related documentation.

Comments:

Over the past two Commissioners Court meetings, we’ve spent considerable time discussing several discrepancies in the Road and Bridge Department’s reporting on the progress and performance of roads funded through our Road Bond program. This includes a significant $7 million variance between different reports, which has raised serious questions about accuracy and accountability.

Given these unresolved issues, I recommended that we pause accepting any new roads into the county maintenance system. We first need to complete a thorough audit and develop a clear plan to address the outstanding road miles in the bond program.

The other Commissioners felt that this D.R. Horton subdivision has been in progress for a long time and that delaying acceptance would unfairly hold up the developers. However, I’m not sure why there was opposition to a short pause of just 3-6 months. If the roads were built properly to both city and county specifications—as they should be—the developers shouldn’t face any unexpected repair costs during that brief wait.

What was the real harm in holding off on adding another 1.155 miles of road to our maintenance system while we straighten up the unresolved issues?

In the end, the Court voted 4-1 to accept the roads, with me—your Precinct 1 Commissioner—casting the sole “no” vote.

I stand by my position: We owe it to Smith County taxpayers to get this right. We should not take on additional road maintenance obligations until we’ve identified and corrected the $7 million reporting discrepancy and have a solid plan in place for completing the remaining bond projects. Prudence and fiscal responsibility demand nothing less—our residents deserve full confidence that their bond dollars are being managed accurately and effectively. As always, I’m here if you’d like to discuss this further!

RECURRING BUSINESS

COUNTY CLERK

13. Consider and take the necessary action to approve the Commissioners Court minutes for November 2025.

14. Receive Commissioners Court recordings for November 2025.

ROAD AND BRIDGE

15. Consider and take necessary action to authorize the county judge to sign the:

a. Replat for East Shores, Unit 3, Lots 196, 197 and 198, Precinct 2, and

b. Final Plat for the Thurman Subdivision, Precinct 3.

16. Receive pipe and/or utility line installation request (notice only) for County Roads 2195, 2268 and 2288, Metronet, install fiber optic cable, Precinct 2.

AUDITOR’S OFFICE

17. Consider and take necessary action to approve and/or ratify payment of accounts, bills, payroll, transfer of funds, amendments, and health claims.

ADJOURN