Commissioners Court Notes

Please note: All agenda items are considered PASSED unless indicated otherwise.

OPEN SESSION:

RESOLUTION

1. Consider and take necessary action to approve a resolution proclaiming January 15, 2026, as “Jerry Benet Embry Day” in Smith County.

COURT ORDERS

COMMISSIONERS COURT

2. Discuss, consider and take necessary action to determine next steps for the Budget Officer position.

Comments:

Purpose of placing this on the agenda: I wanted open discussion with the other Commissioners and Judge Franklin about next steps for the Budget Officer position.

What surprised me in court Tuesday: Judge Franklin stated the item would return next week because “they” (himself, HR Director Esmerelda Corona, and Auditor Karin Smith) had conducted interviews (and apparently identified a candidate). This was the first I’d heard that “they” were interviewing for the Budget Analyst position.

Key background:

- HR posted the Budget Officer position last year after Kari Perkins resigned (Sept 1).

- We received applications, but only a few were qualified.

- The full Commissioners Court interviewed two candidates in executive session.

- The Budget Officer position remains officially open and unfilled.

What it appears that has happened behind the scenes: Judge Franklin, Auditor Karin Smith, and Human Resource Director Esmerelda Corona contacted past Budget Officer applicants to ask if they would consider applying for a Budget Analyst position instead—a role that does not currently exist.

Important distinctions:

- The Budget Officer is a department head who reports to the Commissioners Court, prepares/presents the county budget, and has a salary max of $107,000 + benefits.

- The Auditor reports to the District Judges (separation of powers), not the Commissioners Court.

- A Budget Analyst (max $85,000 + benefits) would support the Auditor, doing much of the budget preparation work, with the Auditor presenting and owning the final budget.

- Since the Budget Officer vacancy began with Kari Perkins’ resignation on September 1, 2025, the County Auditor has been performing the budget officer duties by default to ensure continuity (as is standard practice).

- State law does not require abolition if the position remains unfilled—the office continues to exist, and the Commissioners Court can appoint a new Budget Officer at any time to restore direct court oversight.

- However, if the court chooses to permanently transfer budget preparation to the Auditor’s office, to recapture the budgeted funds from the vacant position—approximately $140,000 including salary and operations—and reallocate them toward a lower-cost Budget Analyst role at $75,000–$85,000 + benefits, we may abolish the separate office only by formal vote during the statutory window: after the first day of the second month and before the first day of the sixth month of the fiscal year. For FY 2026: November 2, 2025, through February 28, 2026 (Texas Local Government Code Ch.111.062).

Serious concerns about the current approach:

- “They” are soliciting interest in a Budget Analyst position that has not been created.

- Reaching out to past applicants (who applied for a $107K leadership role) and asking them to consider a $22K+ pay cut is not likely to attract the best candidates.

- This process bypasses qualified internal county employees who might want to advance through a Budget Analyst role toward Budget Officer.

- It also limits the applicant pool—no public posting means no fresh candidates from across Texas with county experience.

Additional Red Flag: In court, Judge Franklin revealed that during their interviews, applicants were told they were being considered for three possible roles: Budget Officer, Budget Analyst, or Accountant in the Auditor’s Office. This was never communicated to the Commissioners Court. We advertised and interviewed only for Budget Officer.

Bottom line: This is not transparent, not fair, and not how a Commissioners Court should operate. The Judge has equal authority to each Commissioner (except in emergencies)—he cannot unilaterally decide who gets interviewed or pre-select candidates for us to rubberstamp.

I did not defer my responsibility to represent Precinct 1 (nor should any Commissioner defer their precinct). We are a governing body. Decisions of this magnitude belong in open court, with full discussion and input from all members—not behind closed doors.

What should happen instead (proper process):

- Discuss and vote on dissolving the Office of the Budget Officer.

- If approved, discuss and vote on reclassifying the position to Budget Analyst.

- If approved, authorize HR to post the Budget Analyst opening publicly.

- Distribute all qualified applications to each Commissioner and the Judge for review.

- Commissioners Court collectively decides which candidates to interview in court.

This approach applies specifically to department-head-level positions that report directly to the Commissioners Court—not every county vacancy.

We can and should do better. Transparency and collaboration strengthen Smith County government.

Heads Up for Tuesday's Commissioners Court Meeting

In the first agenda item, the Auditor is pushing to buy new budget software this year for $24,300. When I asked where we were getting the money for this, the Auditor said we are pulling the funds from the vacant Budget Officer’s $140,000 budget. This comes before we even vote on whether to keep or abolish that office.

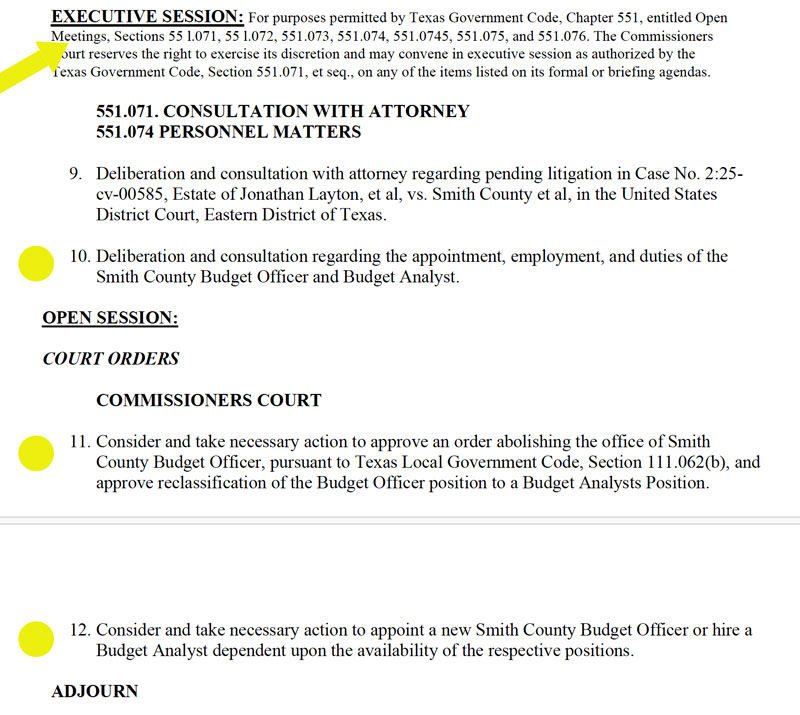

Then the agenda continues to executive session on the duties of the Budget Officer and a new Budget Analyst, followed by open session votes to abolish the office, reclassify the position as Budget Analyst, and hire for whichever role is left.

It reads like the decision is already made—spend the money first, then formalize the end to the Budget Officer and hire for the position that remains. That’s not how open government works. Taxpayers expect us to discuss options fully in public.

We’ve seen what happens when input is limited. The last Budget Officer was selected with narrow involvement, lacked the needed financial expertise, and the results fell short for two cycles. We can’t risk repeating that by letting a few pre-select a candidate for a quick approval.

This is about protecting your money and ensuring real transparency. I’ll be asking the tough questions in court so every Commissioner has a voice. Watch the meeting if you can—your interest keeps us accountable.

Stay engaged, Smith County. We do better when we do it together.

SHERIFF’S OFFICE

3. Consider and take necessary action and authorize the county judge to apply for the Sheriff Immigration Law Enforcement Grant program on behalf of the Sheriff’s Office through the Secretary of State grant portal

Comments:

The Smith County Sheriff’s Office is eligible to apply for a $100,000 state grant. This grant is specifically intended to support sheriffs who have entered into agreements with federal authorities, like the 287(g) agreements, to assist in immigration law enforcement.

Sheriff Immigration Law Enforcement Grant Program:

Grant funds may be spent over a two-year period only on the following:

- Compensation for persons performing duties under the agreement;

- Generating and delivering reports required by the agreement, including administrative duties required under the program;

- Equipment and related services for peace officers and other persons related to the agreement, including the cost of repairing and replacing equipment required, but not provided, under the agreement;

- Attendance by a person at any training or other event required under the agreement;

- Costs to the county for confining inmates under the authority granted under the agreement; and

- Other expenses associated with participating in the agreement as determined by the Texas Comptroller of Public Accounts.

We authorized the Sheriff’s Office to apply for this grant. If awarded, they will bring it back to court to accept the funds.

4. Consider and take necessary action to approve the Sheriff’s Office Detention Officer, one time exception, request to increase pay by $6,991, based on the level of experience.

Comments:

We decided not to submit this item for court approval. The Salary Policy already allows for this pay increase based on experience, as long as the employee is licensed through TCOLE (Texas Commission on Law Enforcement). No additional court approval is required.

5. Consider and take necessary action to approve the Sheriff’s Office Bookkeeper, one time exception, request to increase pay by $16,247, based on the level of experience.

Comments:

A Bookkeeper position opened in the Sheriff’s Office on September 2, 2025.

The Sheriff’s Office first suggested a wide salary range of $41,203 – $61,201 (before the FY26 cost-of-living adjustment). After the 2026 COLA, the top of that range would be around $63,037.

Following standard county policy, HR posted the job on October 3, 2025, with a narrower entry-level pay range of $42,439 – $46,790. This follows Smith County policy, which states:

“All positions revert to entry level when vacated for any reason. Mid-level entry not allowed unless same payroll range was held in another department and there is no break in service.”

During interviews, the Sheriff’s Office might have discussed (or promised) higher pay based on the applicant’s 18+ years of bookkeeping experience. We don’t have the exact details of those talks.

When they saw her strong background could justify pay near the top, they should have checked with HR and the Auditor’s Office first to confirm budget availability and approval for experience pay before finalizing the hire.

The Sheriff’s Office often has extra flexibility because of salary lag — money left over from high turnover, vacant positions, or lower starting salaries. This gives larger departments like the Sheriff’s Office more room to offer higher pay. Smaller offices (such as Judicial Compliance, the Treasurer’s Office, or Elections) don’t have that same cushion in their budgets. They can’t easily hire someone with decades of experience at top pay without straining resources.

This creates an unfair difference in how departments can compete for experienced workers.

This case was handled as a one-time exception. I requested that HR review and update the policy to avoid similar problems in the future.

Last year, there was guidance to hold off on experience-based pay increases during the year and address them only during the annual budget process. Situations like this create confusion for HR: one rule says no mid-year experience adjustments, but a department has already made a commitment.

We need clearer guidelines and processes so HR can handle these fairly and consistently across all county offices. Policy updates will come back to Commissioners Court for approval soon.

After discussion, we approved this one-time exception for the Sheriff’s Office bookkeeper position.

RECURRING BUSINESS

ROAD AND BRIDGE

6. Consider and take necessary action to authorize the county judge to sign the:

- Final Flat for Piney Acres, Precinct 2,

- Re-Plat for the Cumberland Ridge Subdivision, Unit VI, Block 20, Lots 26-28, Precinct 1, and

- Final Plat for the Magnolia Meadows Subdivision, Precinct 1.

7. Receive pipe and/or utility line installation request (notice only) for County Road 3118, West Gregg Special Utility District, install water meter, Precinct 3.

COMMISSIONERS COURT

8. Receive monthly reports from Smith County departments.

Comments:

I’m still working on getting our Department Heads up to the podium during Commissioners Court to share their monthly performance metrics with the citizens. They’re a bit shy about it, but I’m making steady progress!

I see this as a great chance for them to proudly highlight the hard work their teams are doing—whether that’s the number of work orders completed, calls responded to, or fees collected. You deserve to know exactly what you’re getting for your tax dollars. It’s so much more than just road repairs and new buildings.

On another note, we received a new report from the Auditor this month—an Appropriations Summary showing the current status of each department’s budget. It was submitted to the agenda at 8:43 a.m., less than an hour before court started. I asked about it during the meeting.

We used to get a clear Monthly Unaudited Financial Summary from the Auditor’s Office, complete with percentage of budget used, remaining funds, and helpful alerts. The last one I recall was in August. I’m always grateful for any financial reports shared with the Court—we don’t work in the Auditor’s office, so these are key accountability tools we can’t generate ourselves.

I truly value these snapshots. They help me spot potential overages (or under-budgeting) and do my job more effectively. More transparency means better oversight for all of us!

AUDITOR’S OFFICE

9. Consider and take necessary action to approve and/or ratify payment of accounts, bills, payroll, transfer of funds, amendments, and health claims.

ADJOURN