Commissioners Court Notes

Please note: All agenda items are considered PASSED unless indicated otherwise.

OPEN SESSION:

COURT ORDERS

COMMISSIONERS COURT

1. Consider and take necessary action to approve giving Smith County Community Hero Awards to Lindale Police Sergeant Michael Lazarine and Dispatcher Kimberly Smith for their heroic and life-saving actions.

Comments:

It was truly a privilege to celebrate two incredible first responders for their quick thinking and remarkable skills in saving a child’s life. Their heroic story warms the heart, and you can read all about it here…

PRESENTATIONS

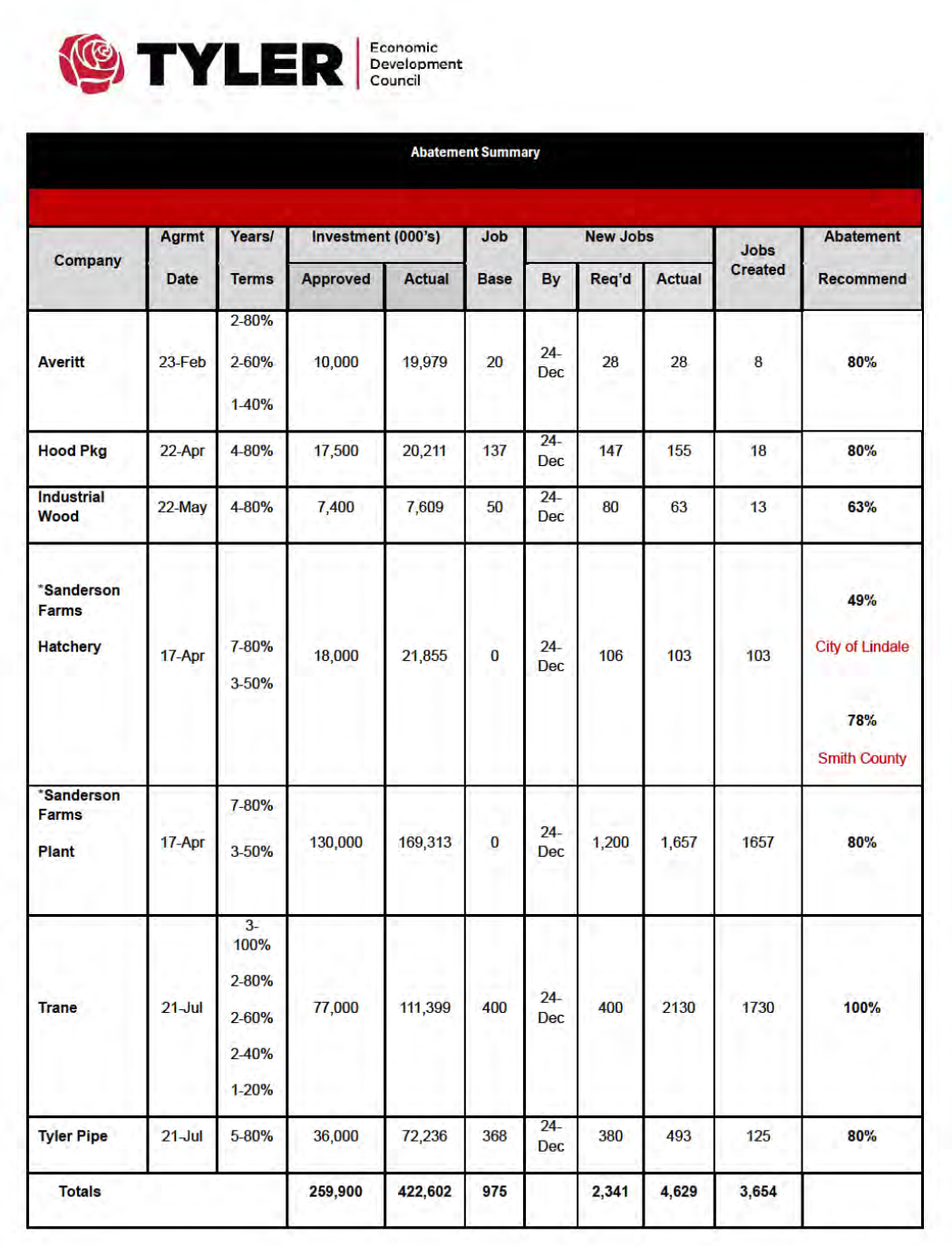

2. Receive annual review of all Smith County Tax Abatements from the Tyler Economic Development Council.

Comments:

Scott Martinez, President of the Tyler Economic Development Council (TEDC), presented the annual review of the tax abatement projects.

How Tax Breaks for Businesses Hurt Everyday Taxpayers

Tax breaks, or “abatements,” are when governments cut taxes for businesses to encourage them to build or grow in an area. While they’re meant to boost the economy, these deals can hurt Tom & Jane Taxpayer in several ways.

Less Money for Public Services: Tax breaks mean less tax money for things like schools, roads, or police. This can lead to worse services or higher taxes for everyone else to make up the difference.

Higher Taxes for You: When big businesses pay less, homeowners and small businesses often get stuck with higher property or local taxes to keep the government running.

Empty Promises: The jobs or growth promised by these deals often don’t happen or only help big companies, not regular people. A 2018 study found many tax breaks don’t deliver the benefits they claim.

More Strain on Services: New businesses or projects increase the need for things like schools or utilities, but with less tax money coming in, regular taxpayers end up covering the extra costs.

Unfair Competition: Big businesses with tax breaks can outcompete smaller local shops that don’t get the same help, hurting the local economy and jobs that taxpayers depend on.

Comments:

On July 9, the Smith County Tax Abatement Committee reviewed seven abatement projects as of December 31, 2024:

- Created 3,654 new jobs and retained 975 jobs

- $423 million invested in new plant and equipment

- Four of five county projects – Averitt Express, Sanderson Farms Hatchery and Plant, Tyler Pipe – paid taxes on time

- Two City of Tyler projects – Hood Packaging, Trane Technologies – also current on taxes

- Up to $4.4 million (estimated) in Smith County taxes deferred over the life of the remaining abatements, based on the current tax rate of .330000, and depending on the appraised value.

For a deeper dive, the detailed report on each project is included in the agenda packet starting on page 13.

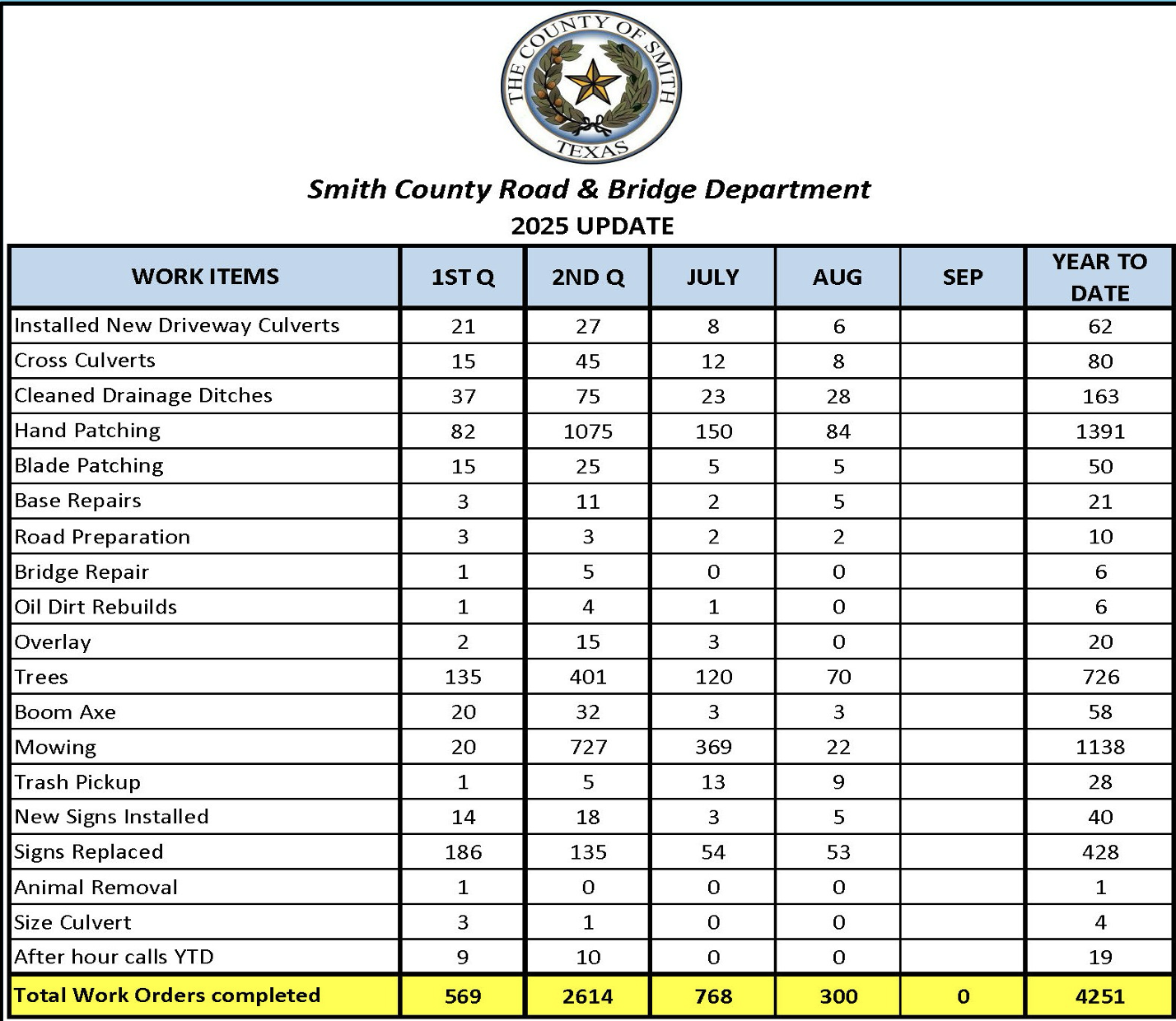

3. Receive update from the Road and Bridge department.

Comments:

Frank Davis, our County Engineer, delivered a presentation on the ongoing Phase 2 Road Bond Projects, detailing progress and completed work through 2025. While several departments provide monthly reports, the Road and Bridge Department has not consistently done so. Transparent metrics from all departments are essential to demonstrate the value taxpayers receive for their contributions. I had requested such reporting earlier this year, and I am grateful to Mr. Davis for successfully implementing this initiative.

Click the button below to review the Powerpoint.

Comments:

Slide 2: Phase 2 Road Bond Program Projects Update

- Purple/Pink Project Numbers: in process

- Green Project Numbers: complete

- Orange Project Numbers: projects that have been bid

Slide 3: In House Paving and Reconstruction

The Road and Bridge Department has completed 19.922 miles of roadwork in FY25 and has scheduled 33 miles for FY26.

Slide 4: Road and Bridge 2025 Update

As FY25 draws to a close, the Road and Bridge Department reports completing 4,251 work orders. The report details various categories, including the installation of 62 driveway culverts and 80 cross culverts, cleaning of 163 drainage ditches, and completion of 726 tree-trimming work orders. These metrics establish a strong baseline for tracking future progress and evaluating departmental performance.

COURT ORDERS

4. Consider and take necessary action to approve the termination of the Tax Abatement Agreement

Comments:

The Tyler Economic Development Council (TEDC) recommended termination of the Tax Abatement Agreement with Industrial Wood Technology (IWT) for non-compliance. On 3/28/22, the committee recommended a 4-year 80% tax abatement for IWT for the creation of 40 jobs and up to $7.4 million in new investment. As of 12/31/24, IWT had invested $7.6 Million and only created 13 jobs. They needed to reach an overall target of 80 jobs. They did not meet the job requirement and they were delinquent on their 2024 taxes. The Commissioners Court approved the termination of the Tax Abatement Agreement with IWT.

5. Consider and take necessary action to approve amendments to the FY 2025 – 2029 Capital Improvement Plan including but not limited to Animal Control Facility, Technology Projects, and any other necessary projects.

Comments:

I have reported on this issue during the Budget Workshops. The Capital Improvement Policy defines a Capital Project as a set of activities with related expenditures that include:

- Delivery of a distinct asset or improvement that can be recorded as a capital asset.

- Any capital improvement contribution by SC to another government or not-for-profit entity including those contributions that do not become assets of SC.

- Any engineering study or master plan that is necessary for the delivery of a capital project.

- Major repairs, renovations, or replacement of existing facilities.

I voted against the proposed amendments to the Capital Improvement Plan because certain technological components do not fully align with our established policy. The inclusion of additional IT elements in the CIP has unfortunately led to the removal of plans for a new animal shelter facility. Having gained insight into the internal processes, I am concerned that the commitment to constructing a new shelter may not have been as firm as initially presented. This is disappointing to our community, especially given the time and taxpayer resources invested in the Shelter Planners of America Feasibility Study. I understand that budgetary adjustments were needed due to an oversight in the IT budget, and I want to emphasize that this error does not reflect on the IT Director’s performance. There were approximately $4 million in ARPA interest funds available that could have addressed this shortfall. However, it appears Judge Franklin may have other plans for these funds, which have not yet been brought before the Commissioners Court for open discussion and approval. I look forward to a transparent dialogue to ensure our community’s priorities are met.

6. Consider and take necessary action to reappoint Matthew Watts as a Smith County representative to serve on the Northeast Texas Regional Mobility Authority (NET RMA) Board of Directors, to serve a two-year term beginning February 2, 2025.

Comments:

The letter in our agenda packet stated that Mr. Watts’ term on the NETRMA board ended on February 1, 2025. According to the NETRMA bylaws, we needed to either reappoint Mr. Watts or select a new representative for the term running from February 2, 2025, to February 1, 2027. We chose to reappoint Mr. Watts. It’s concerning that details like this can be overlooked.

7. Consider and take necessary action to approve the two-year bond renewal for Smith County Purchasing Director, Jaye Latch, effective October 1, 2025, and authorize the county judge to sign related documentation.

Comments:

We approved the bond renewal.

SHERIFF’S OFFICE

8. Consider and take necessary action to approve the FY 2027 Regional Solid Waste Grant on behalf of the Smith County Sheriff’s Office and authorize the county judge to sign all related documentation.

Comments:

The ETCOG Solid Waste Grant helps cover $4,000 of the costs for the Countywide Cleanup project. This grant rotates, so Smith County has to skip every third year. If awarded, the grant will support the project in the FY27 budget year. For 2025, Smith County spent $19,650 on the Countywide Cleanup project.

AUDITOR’S OFFICE

9. Consider and take necessary action to approve changes to the Nationwide Retirement Plan documentation and authorize the county judge to sign all related documentation.

Comments:

The Auditor advised the Court to postpone this item because of errors found in the documents. It will be brought back to the Court once the errors are corrected.

10. Consider and take necessary action to modify the county pay scale to correct the Interpreter Coordinator supplement amount and authorize the county judge to sign all related documentation.

Comments:

During the review of pay scales, the Auditor’s Office discovered that a stipend for the Interpreter Coordinator, included in the FY25 budget, was not applied. The owed amount of $2,500 was approved for payment.

FCIC

11. Consider and take necessary action to approve an Interlocal Agreement between Smith County, Smith County Criminal District Attorney’s Office, and Texas Department of Licensing and Regulation (TDLR) for the continued operation of the Financial Crimes Intelligence Center (FCIC) and authorize the county judge to sign all related documentation.

Comments:

The FCIC is funded by the State and the interlocal agreement is necessary to continue operations.

12. Consider and take necessary action to approve a Lease agreement for FCIC office space with Communication Professionals Ltd, New Braunfels, TX, and authorize the county judge to sign all related documentation.

Comments:

As discussed in prior Commissioners Court meetings, the FCIC received state approval to expand its operations. To establish a statewide presence, they are leasing new office spaces. This lease covers an office in New Braunfels. The FCIC has already secured office spaces in the Dallas and Houston areas.

RECURRING BUSINESS

ROAD AND BRIDGE

13. Receive pipe and/or utility line installation request (notice only):

a. County Road 2138, 2186, 2185, 2144, Charter-Spectrum, install underground fiber optic cable with vaults, Precinct 2, and

b. County Road 1151, CenterPoint Energy, install gas line, Precinct 4.

14. Consider and take necessary action to authorize the county judge to sign the:

a. Re-Plat for Dove Ridge, Phase Two, Precinct 4, and

b. Re-Plat for Family Dollar Tyler, Lot 2 Block A, Precinct 3.

AUDITOR’S OFFICE

15. Receive monthly Auditor report and Executive Summary for August 2025.

Comments:

Our health insurance and inmate medical costs continue to skyrocket. The Auditor projects that inmate medical expenses will exceed the budget by $700,000. In pre-court discussions, the Auditor noted that an additional $1 million may need to be transferred to cover employee healthcare costs for FY25. After conducting a budget sweep, they hope to recover enough funds to return to the General Fund.

To review the Unaudited Financial Report & Executive Summary for August 2025, click on the link below.

16. Consider and take necessary action to approve and/or ratify payment of accounts, bills, payroll, transfer of funds, amendments, and health claims.

Comments:

Budget Transfers and Payments

Justice of the Peace Precinct 1

- Transfer From: Contingency – $5,000

- Transfer To: Autopsies – $5,000

Veterans Department

- Transfer From: Contingency – $310.00

- Transfer To: Training – $310.00

Bank Wires

Recipient: Optum RX, Inc.

- Prescription Claim Cost Billing: $135,533.98

- Claim Fee Billing: $2,000

- Total Balance Due: $137,533.98

EXECUTIVE SESSION:

For purposes permitted by Texas Government Code, Chapter 551, entitled Open Meetings, Sections 55 l.071, 55 l.072, 551.073, 551.074, 551.0745, 551.075, and 551.076. The Commissioners Court reserves the right to exercise its discretion and may convene in executive session as authorized by the Texas Government Code, Section 551.071, et seq., on any of the items listed on its formal or briefing agendas.

SECTION 551.074 PERSONNEL MATTERS

SECTION 551.071 CONSULTATION WITH ATTORNEY

17. Deliberation and consultation regarding the qualifications, responsibilities, and salary of the Smith County Animal Control and Shelter Supervisor Position.

18. Deliberation and consultation regarding the qualifications, responsibilities, and salary of the Smith County Budget Officer Position.

ADJOURN