Commissioners Court Notes

Please note: All agenda items are considered PASSED unless indicated otherwise.

OPEN SESSION:

RESOLUTION

1. Consider and take necessary action to adopt a resolution proclaiming June 17, 2025, as “Senior Bishop Lawrence L. Reddick III Day” in Smith County.

PRESENTATION

2. Receive presentation from the Road and Bridge department regarding the Smith County Road Bond Program.

Road Bond Program Phase 2 Update

Comments:

The video clip above is of the Road & Bridge presentation and subsequent Q & A. We had a presentation on the Road Bond Program on March 11th to update the public on the program. Please review my comments on that report here.

The presentation aimed to inform the public about the remaining roads to be completed and the additional funding needed to fulfill the program’s promises. However, I believe it lacked clarity for taxpayers, offering only a high-level overview of the project and the increased costs.

In summary, building the same mileage of roads in 2026 is more expensive, requiring additional funding. Current estimates suggest an additional $15 million beyond the original $20 million bond allocation. I requested a monthly update from Road and Bridge on their progress on the Road Bond Program Phase 2.

On the County website, the Road Bond Program Phase 2 list is available to review anytime.

COURT ORDERS

COMMISSIONERS COURT

3. Consider and take necessary action to approve the proposed Fiscal Year 2025-2026 District Operating Budget of the Smith County 9-1-1 Emergency Communications District and authorize the county judge to sign all related documentation.

Comments:

The Smith County Commissioners Court must approve the operating budget for the Smith County 9-1-1 Emergency Communications District, as required by Texas Health and Safety Code Section 772. This ensures fiscal accountability and alignment with public safety goals. Did you know that the Smith County Voters approved the creation of the Emergency Communications District in 1986? Smith County 9-1-1 District is 1 of 26 Districts throughout the state of Texas.

4. Consider and take necessary action to adopt a resolution supporting the efforts of Visit Tyler to bid and have the 2027 North and East Texas County Commissioners Association Annual Conference in Tyler.

TAX OFFICE

5. Consider and take necessary action to approve tax refunds in excess of $2,500, pursuant to Texas Tax Code 31.11 and authorize the county judge to sign all related documentation.

Comments:

This was an overpayment of property taxes from Truly Title.

RECURRING BUSINESS

COUNTY CLERK

6. Consider and take the necessary action to approve the Commissioners Court minutes for June 2025.

Comments:

For the June 24th meeting of the Commissioners Court, the Minutes did not capture the time of adjournment. Judge noted in court that it had been corrected.

7. Receive Commissioners Court recordings for June 2025.

ROAD AND BRIDGE

8. Consider and take necessary action to authorize the county judge to sign the:

- Final Plat for Lakeview Grove, Lots 1 and 2, Precinct 1,

- Final Plat for the Landrum Subdivision, Precinct 2, and

- Re-Plat for Red Rock Estates, Lot 7, Precinct 1.

9. Receive pipe and/or utility line installation request (notice only):

- County Road 389, Cherokee County Electric, install line for service, Precinct 3, and

- County Road 2115, Charter-Spectrum, install underground conduit, new power supply and new pole, Precinct 2.

AUDITOR’S OFFICE

10. Consider and take necessary action to approve and/or ratify payment of accounts, bills, payroll, transfer of funds, amendments, and health claims.

Comments:

This is the end of the fiscal year and it can be a time period where Department Heads and Elected Officials move budgeted funds around from one expense line to another to spend funds on unbudgeted items. There were 4 transfers submitted to the court:

1.) Constable Precinct 2, Wayne Allen – Page 92 in the packet

- Transfer FROM Miscellaneous Vehicle Equipment (for upfitting vehicles), Office Supplies and Membership Dues for a total amount of $4735

- Transfer $2,750 TO Miscellaneous Equipment and $1,962 TO Uniform Contracts

- Explanation: “Cover cost of GT Distibutors PO Duty Pistols and Gear and the uniforms from Got Ya Covered.”

*Starting in 2023, Smith County began purchasing firearms for its law enforcement officers. Previously, officers were required to provide their own duty pistols. The County has never sold any taxpayer-funded firearms back to officers.

Smith County Constable Precinct 2 wants to buy two new pistols: one to replace a firearm that he will sell to a retiring deputy and one to keep as a backup in case an officer’s gun is taken during a shooting investigation. After some discussion about this new practice, I think that the County has an opportunity to implement a policy and practice regarding the sale of firearms.

Currently, the Smith County Purchasing Department records the number of firearms purchased but does not tag or physically inventory items costing less than $5,000. The County Auditor is responsible for inventorying assets valued over $5,000 for capital depreciation purposes but does not track lower-value items like most firearms.

To protect taxpayers and follow the law, I propose a clear policy to:

- Require tagging and annual physical inventory of all county-owned firearms, regardless of cost, to ensure accountability.

- Define a process for determining the fair market value of firearms sold, as counties are prohibited from profiting on surplus sales under Texas law.

- Clarify responsibilities for complying with federal and state firearm transfer regulations, including completing ATF Forms and ensuring background checks through licensed dealers.

- Designate the Sheriff’s Office or Purchasing Department as the entity responsible for overseeing sales and ensuring compliance.

This policy will ensure responsible handling of county firearms, protect public funds, and keep sales legal and transparent.

2.) Sheriff – Page 90 in the Packet

- Transfer FROM Miscellaneous Repairs and Radio Repairs for a total amount of $5,146.

- Transfer $5,146 TO Estray Expenses

- Explanation: “Facility Services budgets for repairs, so the Sheriff’s account is rarely used for repairs, leaving available budget to use. IT budgets for radio repairs, so the SO radio repair line is rarely used and has available budget to use in other areas.”

3.) Constable Precinct 4, Josh Joplin – Page 93 in the Packet

- Transfer FROM Training Expense, Uniform Contract, Miscellaneous

Equipment in the amount of $5700. - Transfer $5700 TO Miscellaneous Vehicle Equipment.

- Explanation: “To cover the cost for additional vehicle upfitting. Funding that was provided by TAC through insurance was only for equipment and vehicle replacement. So upfitting cost would fall within our regular budget. Due to the vehicle loss being in September, it was too late to budget for this expense since the budget had already been voted on.”

4.) Justice of the Peace, Precinct 5 – Judge Danny Brown – turned in after the Packet was released.

- Transfer FROM Miscellaneous Equipment and Training Expense in the amount of $2,500.

- Transfer $2,500 TO Part Time Salary

- Explanation: “Part time employee got approved to work full time hours for six weeks due to 2 full time employees being out on medical leave. During that time the pay came from the part time budget. Funds are needing to be transferred so that part-time employee can continue working until the end of the fiscal year.”

End of Year Budget Transfers

Current Issue in Fund Balance: The County has had to pull extra funding from the General Fund to supplement the Healthcare Claims costs for a total of about $4 Million on top of the budgeted amount. Healthcare Claims are astronomically high this year. The County is not going to limit access to healthcare to control costs – it must be paid. That is necessary. The $4 Million should be replaced in the General Fund with any remaining dollars from department budgets. Meaning – if they do not purchase what was budgeted for, that money will be used to recover the loss of $4 Million from the General Fund.

Emergency Purchases: When a Department Head or Elected Official has a true emergency, something unforeseen and unplanned, the Court has a duty to approve the extra funding for that emergency need. That can come from within their budget or from Contingency fund lines IF they do not have the funding from within their own departmental budget.

My Concern: IF a Dept Head/Elected Official overbudgeted for a pork line item (i.e. Miscellaneous Equipment, Training Expense, Membership Fees) to have extra funding for end of year purchases that they did not specifically budget for, that is not transparent and it contributes to higher taxes.

Last Fiscal Year: There was $10,200,000 returned to the reserves from departmental budgets. (The Reserve Fund has restrictions for use.) When the previous Commissioners Court and the Budget Officer designed the budget, the result was over taxation on the public by $10,200,000 and that was largely due to department’s budgets being overinflated and then unspent – “padding”. Your property taxes will never be reduced if this is allowed to continue.

I was expecting a bill for May/June from UT Health for Inmate Medical to be on the weekly bill pay. The Auditor said they are holding payment awaiting answers from UT Health. The fact is that our Inmate Medical costs are on the rise.

- For Fiscal Year 2024, the combined total for inmate medical expenses was $3,293,235.

- This year we are on track to close out at $5,707,170 or a 73% increase in a year.

I want to make sure we are getting a competitive value for these services, without compromising quality, so I would like to put this out to bid to check the market. Our current contract with UT expires at the end of September.

EXECUTIVE SESSION:

For purposes permitted by Texas Government Code, Chapter 551, entitled Open Meetings, Sections 55 l.071, 55 l.072, 551.073, 551.074, 551.0745, 551.075, and 551.076. The Commissioners Court reserves the right to exercise its discretion and may convene in executive session as authorized by the Texas Government Code, Section 551.071, et seq., on any of the items listed on its formal or briefing agendas.

ADJOURN

RED FLAG!!

The FY26 budget process is veering off course. Unlike past years, our Commissioners Court Budget Workshops lack critical funding discussions, leaving us unprepared. I’ve heard from several department heads that expressed their concern with the lack of clarity in the process.

The Budget Officer originally declared she would have a rough draft by July 1, then delayed to July 15, then July 22. On July 16, I requested a copy of the working budget and was denied—the budget was “not ready.” The July 22 agenda confirmed no budget presentation. We’re now told to expect it on July 29, but at this point, I can’t make you any promises. The Budget Calendar shows that we are supposed to take a record vote on a tax rate on August 5. How can we set a tax rate without a thoroughly reviewed budget? When the budget is close to $150 Million, I have a hard time thinking it will be perfect right out of the chute.

How can we receive the budget on July 29 and be prepared to make substantive changes? There’s no time for a complete review before, during, or after the meeting, nor to incorporate changes and make another presentation before the tax rate discussion. This rushed process disrespects the public, Department Heads, Elected Officials, and Commissioners.

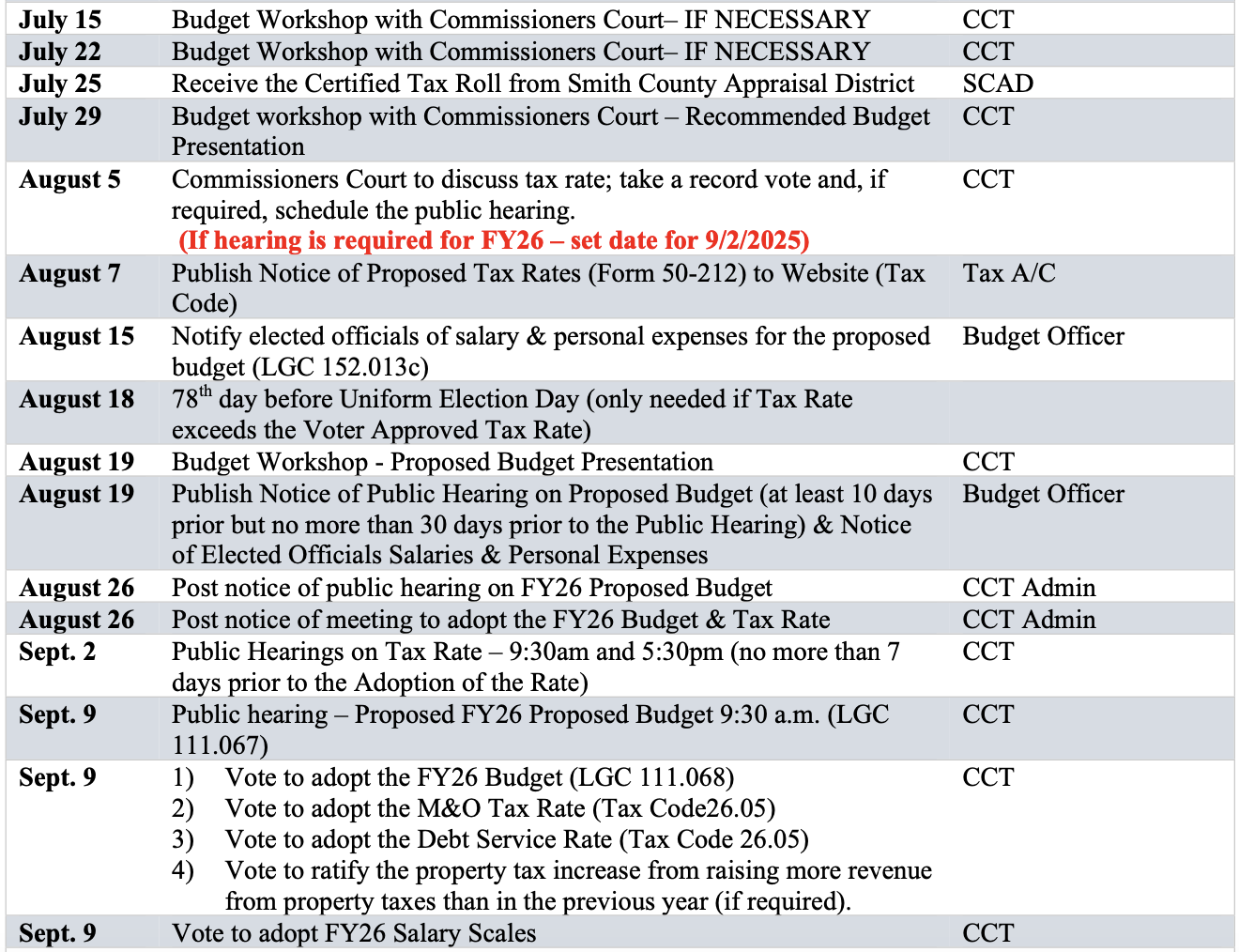

REMAINDER OF THE BUDGET CALENDAR