Commissioners Court Notes

Please note: All agenda items are considered PASSED unless indicated otherwise.

OPEN SESSION:

PUBLIC HEARING

- Receive input regarding amending the Smith County Tax Abatement Policy.

Comments:

This item was listed as a “Public Hearing,” yet no one spoke either for or against the proposed policy changes.

- Did anyone receive any notification from Smith County about this Public Hearing—beyond the agenda being posted late Friday afternoon?

- How can the public provide informed input when there are no supporting documents included in the public agenda packet? The only item available to the public was the Agenda Request Form.

This process gives the public the impression that they are being deliberately excluded, further reinforcing the widespread mistrust in our government institutions.

How the Process Currently Works:

- Agenda Item Request Forms are due by Wednesday at 5:00 PM.

- A draft agenda is compiled by Thursday afternoon.

- The County Judge approves the final agenda after it is reviewed and recommended by the County Attorney, Thomas Wilson.

- The finalized agenda is posted and emailed Friday midafternoon, along with a public version of the agenda packet.

- Once posted, no changes can be made.

- This particular agenda item was submitted by Thomas Wilson.

Until we, as a Court, commit to improving transparency and ensuring the public has adequate time and access to relevant information, public trust in our local government will continue to erode.

My Recommendations for Notices of Public Hearings:

*Continue to meet the legal requirements for posting on the county website and/or newspaper and:

- Post on Social Media platforms to increase visibility. Include supporting document links for review.

- Email to subscribers of a County Newsletter.

- Notifications or Alerts through systems like GovDelivery or CodeRED.

- Advertise the Public Hearing giving 7-14 days’ notice.

When the item came up for a vote, Item 19, I voted against the changes because I had input from my constituents outside of the meeting. See Item 19 for more information.

RESOLUTION

2. Consider and take necessary action to adopt a resolution proclaiming June 2025, as “Elder Abuse Prevention Month” in Smith County.

PRESENTATION

3. Receive presentation from Lisa McCaig with Texas Association of Counties Risk Management Pool regarding Smith County’s Liability and Property coverage renewal for July 1, 2025 – July 1, 2026.

Comments:

This presentation covered the County’s property and liability insurance renewals, which are approaching the end of the current policy period. Essentially, this serves as our County’s insurance policy, encompassing several areas of coverage, including:

- Auto Liability

- Auto Physical Damage

- General Liability

- Law Enforcement Liability

- Cybersecurity Coverage (Privacy or Security Event Liability and Expense)

- Public Officials Liability

Our insurance costs have risen significantly, largely due to an increase in vehicle-related claims and lawsuits.

Unfortunately, no supporting documents were included in the public agenda packet for this item. While some details are not available for public release, I am able to share the fiscal impact and the loss ratios that were presented and discussed during Commissioners Court.

If you’d like more information, you can submit a public information request.

- Loss Ratio = Claims paid / Premiums collected

- A ratio over 100% means the insurer is paying out more claims than we are paying in premiums.

Higher Loss Ratios are the reason for cost increases:

- For Auto Liability: 258% (for every $1 paid in premiums, $2.58 is paid out in claims)

- For Auto Physical Damage: 208%

- For General Liability: 93%

- For Law Enforcement Liability 682% (this is extremely high-risk)

- For Public Official Liability: 129%

Deductible Changes due to the Claims Experienced:

This means we are now responsible for more out-of-pocket costs before insurance kicks in.

Law Enforcement Liability Deductible is increasing from $50K to $100K.

Public Officials Liability Deductible is increasing from $10K to $25K.

Property Coverage Premium:

July 2024 – July 2025 Yearly Premium: $288,902

July 2025 – July 2026 Yearly Premium: $331,306 or an increase of almost 15%

Liability Coverage Premium:

July 2024 – July 2025 Yearly Premium: $642,144

July 2025 – July 2026 Yearly Premium: $859,799 or an increase of almost 34%

COURT ORDERS

ANIMAL CONTROL

4. Consider and take necessary action to approve the transfer of Unit #3415 (2014 Chevrolet Tahoe) to Animal Control and authorize the county judge to sign all related documentation.

Comments:

Animal Control is currently short one vehicle, as their 2018 Chevy Silverado is out of service. A 2014 Chevy Tahoe, previously designated as surplus and scheduled for auction, became available. To ensure continued service, the court approved the transfer of the Tahoe to Animal Control, allowing the officer to respond to calls without interruption.

The 2018 Silverado may be repaired and retained as a backup vehicle or, alternatively, sold at auction depending on the cost-effectiveness of the repairs.

COMMISSIONERS COURT

5. Consider and take necessary action to authorize the Purchasing Director to advertise and receive sealed bids for On-Site Sewage Facilities Designated Representative for Smith County.

Comments:

On 11/21/05, Smith County approved an Order and Rules for On-Site Sewage Facilities (OSSF). This designated representative is responsible for the administration, inspection, and enforcement of the On-Site Sewage Facility in Smith County. The current Designated Representative is retiring. Consistent with the previous appointment of Pledger & Associates, the County is seeking to bid this contract out. There are minimal direct costs to the County associated with the OSSF program. The Designated Representative charges a fee for inspection and permit application based on specifications of the OSSF system.

6. Consider and take necessary action to reappoint board members to the Tax Increment Reinvestment Zone Board (TIRZ) number 3 and 4 for a two-year term, to represent Smith County’s four seats for each TIRZ and authorize the county judge to sign all related documentation.

a. TIRZ 3, Position #6 for term beginning May 22, 2025, and expiring May 22, 2027.

b. TIRZ 3, Position #8 for term beginning May 22, 2025, and expiring May 22, 2027.

c. TIRZ 4, Position #5 for term beginning June 14, 2025, and expiring June 14, 2027.

d. TIRZ 4, Position #7 for term beginning June 14, 2025, and expiring June 14, 2027.

Comments:

Appointments as follows:

- TIRZ 3, Position #6: Kari Perkins, Smith County Budget Officer

- TIRZ 3, Position #8: Joe Turner

- TIRZ 4, Position #5: Ralph Caraway, Smith County Commissioner Pct 1

- TIRZ 4, Position #7: Neal Franklin, Smith County Judge

7. Consider and take necessary action to approve and Auto Claim settlement for TAC Claim Number ADP20253058-1 and authorize the county judge to sign all related documentation.

Comments:

This was a total loss of a Smith County Road and Bridge 2022 Chevy Colorado. The adverse driver was at fault. We approved the salvage option with a net payment of $6,706.46.

FINANCIAL CRIMES INTELLIGENCE CENTER (FCIC)

8. Consider and take necessary action to approve an amendment and Change Order to Kaseware Subscription Agreement for the benefit of the Financial Crimes Intelligence Center (FCIC) at a cost of $114,532.00 from FCIC funds.

The Financial Crimes Intelligence Center (FCIC) is expanding its number of Kaseware Connections user licenses to fourteen. This annual subscription, totaling $114,532, is fully funded by the State’s appropriations through the Texas Department of Licensing and Regulation, with no use of County funds.

Kaseware is an advanced investigative case management and intelligence analysis platform designed specifically for law enforcement and intelligence agencies. It integrates case tracking, data sharing, link analysis, and geospatial tools into a single, secure system. By using Kaseware, FCIC analysts can manage and analyze complex financial crime investigations more efficiently—connecting suspects, transactions, entities, and timelines in real time. The platform supports collaboration across jurisdictions, allowing local law enforcement agencies to securely share and access intelligence data, which is crucial in multi-agency fraud investigations.

Over the past three years, the FCIC has leveraged tools like Kaseware to help prevent $350 million in fraud and has played a key role in the arrest and incarceration of more than 850 suspects. Expanding access to Kaseware ensures that the FCIC can continue scaling its operations to meet the growing demand for financial crime investigation support across Texas.

To learn more about the State’s Financial Crimes Intelligence Center, please visit: https://fcic.texas.gov

9. Consider and take necessary action to approve an amendment to the agreement between Smith County and Thompson Reuters, DBA West Publishing Corporation, for Clear-Proflex software for the benefit of the Financial Crimes Intelligence Center (FCIC) with monthly payments of $10,498.95.

Comments:

Due to the continued growth of the Financial Crimes Intelligence Center (FCIC), this amendment is necessary to increase the number of user licenses for the CLEAR-ProFlex software. The expansion supports the FCIC’s increasing workload and demand for investigative resources. This program is fully funded by state appropriations through the Texas Department of Licensing and Regulation, with no use of County funds. The monthly cost for the service is $10,498.95.

CLEAR-ProFlex is a powerful analytical tool that processes and organizes large volumes of data, enabling investigators to identify patterns, establish connections between suspects, and build stronger cases. It generates detailed graphs, timelines, and visual charts that are used in court to clearly present complex evidence to prosecutors, juries, and judges. This software significantly enhances the FCIC’s ability to support local law enforcement in fighting financial crimes across Texas.

ROAD AND BRIDGE

10. Consider and take necessary action to accept the completion of the construction contract for Roadway Improvements to CR 411 with an underrun amount of $26,344.43, authorize the county judge to execute the Reconciliation Change Order, and authorize final payment to Texana Land & Asphalt, Inc.

Comments:

We accepted completion of CR 411 (I-20 to FM 849) as performed by Texana Land & Asphalt, Inc. The Contract was awarded in the bid amount of $409,140.20 and the final construction cost was $382,795.77, resulting in an UNDERRUN of $26,344.43. This was for 1.231 miles of roadway. The majority of the underrun was an unused allowance for unknown conditions of $20,000. Please see the packet, posted on my website, for the complete Reconciliation Change Order.

11. Consider and take necessary action to accept the roadways of Arbor Estates, Phase 3 into the Smith County Road Maintenance System.

Comments:

Arbor Estates was platted in 2010 in accordance with the Smith County Subdivision Regulations. The developer was requesting that the Road and Right of Way for Arbor Estates Phase 3 be accepted into the Smith County Road Maintenance System. This is a continuation of Karah Lane inventoried as CR 4229.

TREASURER’S OFFICE

12. Consider and take necessary action to award a contract for RFP-23-25 Managing Bank Depositories and authorize the county judge to sign all related documentation.

Comments:

The Treasurer, Kelli White, recommended awarding the contract to Southside Bank.

- Lower fees and charges offered by Southside.

- Better service, including delivery of paper statements, while Bank of America requires digital delivery that would increase staff workload.

- Higher interest rates from Southside (1–2% more than Bank of America).

- Bank of America requires a $25 million non-interest-bearing balance, costing the county approximately $665,000 per month in lost interest.

- Bank of America was unable to meet most service requirements.

Given Southside’s lower costs, better interest rates, and proven service over 25 years, the recommendation strongly favored them.

SHERIFF’S OFFICE

13. Consider and take necessary action to authorize a grant application for application for the FY 2025 COPS Grant for Hiring and authorize the county judge to sign all related documentation.

Comments:

This request was to apply for the FY2025 COPS Grant through the U.S. Department of Justice to hire four patrol deputies. If approved, the grant would provide up to $125,000 per deputy, totaling $500,000 over a three-year period. The grant follows a 75/25 cost-sharing structure, with the County responsible for covering 25% of the total expenses.

The $500,000 in federal funding would primarily cover costs for just over two years. In the final year, the County would assume the majority of the financial responsibility for the deputies’ salaries and benefits, estimated at approximately $465,760.

This grant is designed to help law enforcement agencies expand their workforce by funding the addition of full-time officers, ultimately enhancing community policing capacity and supporting local crime prevention efforts. There is no assurance that the grant will be awarded. While I acknowledge the urgent need for additional patrol deputies, we must recognize that this grant could artificially inflate the budget. The grant does not cover associated costs for hiring new deputies, including onboarding, equipment, weapons, vehicles, and their upfitting. These expenses must be carefully considered during budget discussions.

RECURRING BUSINESS

ROAD AND BRIDGE

14. Consider and take necessary action to authorize the county judge to sign the Re-plat for the William Short Subdivision, Lots 2 and 3, Precinct 2.

AUDITOR’S OFFICE

15. Consider and take necessary action to approve and/or ratify payment of accounts, bills, payroll, transfer of funds, amendments, and health claims.

EXECUTIVE SESSION: For purposes permitted by Texas Government Code, Chapter 551, entitled Open Meetings, Sections 55 l.071, 55 l.072, 551.073, 551.074, 551.0745, 551.075, and 551.076. The Commissioners Court reserves the right to exercise its discretion and may convene in executive session as authorized by the Texas Government Code, Section 551.071, et seq., on any of the items listed on its formal or briefing agendas.

SECTION 551.071 – CONSULTATION WITH ATTORNEY

SECTION 551.087 – DELIBERATION REGARDING ECONOMIC DEVELOPMENT NEGOTIATIONS

16. Deliberation and consultation with attorney regarding Neches & Trinity Valley Groundwater Conservation District water well applications for Redtown Ranch Holdings, LLC and Pine Bliss, LLC.

17. Deliberation and consultation with attorney regarding Texas Tax Code, Chapter 312 tax abatement guidelines and criteria and discussion regarding commercial or financial offers, incentives, or information within Smith County and the downtown area.

OPEN SESSION:

COMMISSIONERS COURT

18. Consider and take necessary action to authorize the county judge to file notice of contest of the well permit applications of Pine Bliss, LLC and Redtown Ranch Holdings, LLC with the Neches & Trinity Valley Groundwater Conservation District and engage Allison, Bass & Magee, LLP to provide legal assistance.

Comments:

Many regional governing entities are contesting the well permit applications of Pine Bliss, LLC and Redtown Ranch Holdings, LLC with the Neches & Trinity Valleys Groundwater Conservation District because the proposed extraction of over 15 billion gallons of water annually from the Carrizo-Wilcox Aquifer could deplete local water supplies. This threatens residents’ wells, agriculture, and small water systems, impacting rural economies and drinking water access. Engaging an attorney ensures legal expertise to challenge the permits, protect the aquifer, and represent community interests against potential corporate over-extraction for profit. My concern was regarding the open-ended nature of the service contract and the absence of any limits on spending or cost-sharing. To address this, we included a not-to-exceed amount of $50,000 for the attorney’s services. Amendments can be made in the future if necessary.

Applicants: Pine Bliss, LLC and Redtown Ranch Holdings, LLC, both associated with Conservation Equity Management (CEM), applied for permits to drill high-capacity wells into the Carrizo-Wilcox Aquifer. Pine Bliss seeks to drill 22 wells in Henderson County, while Redtown Ranch Holdings applied for 21 wells in Anderson and Houston Counties.

Scale: The combined applications request the extraction of over 15.3 billion gallons of groundwater annually, with estimates ranging up to 25 billion gallons in some reports. This volume is equivalent to the water usage of over two million Texans and raises concerns about aquifer depletion.

Purpose: The water is potentially intended for export to urban areas like Dallas-Fort Worth, though CEM claims the current applications are for drilling permits only, to collect data, and not for immediate production or export.

State Senator Robert Nichols (R-Jacksonville), State Representative Cody Harris (R-Palestine), and State Representative Trent Ashby expressed strong opposition, with Harris calling for a state-level hearing in Austin on July 15, 2025.

On June 19, 2025, the NTVGCD held a public hearing at Jacksonville City Hall, where residents and officials voiced opposition. The district’s board unanimously decided to table the decision for 90 days, extending deliberations until approximately September 17, 2025.

Check https://ntvgcd.org for updates on the permit applications and board decisions.

19. Consider and take necessary action to approve and amend the Smith County Tax Abatement Policy pursuant to Texas Tax Code, Section 312.002, and authorize the county judge to sign all related documentation.

Comments:

The supporting documents with the changes were not made available in the public packet once again.

The amended Smith County Tax Abatement Policy, effective June 17, 2025, introduces a significant shift by removing the specific examples of eligible facilities—such as manufacturing, distribution centers, and research facilities—that were outlined in the original policy dated May 25, 2025. This change is designed to broaden the policy’s scope, allowing a wider variety of projects to be considered for tax abatements based on their economic impact, including new facilities or expansions that meet criteria like a $1 million capital investment, a $400,000 annual payroll increase, or the creation of 25 new full-time jobs.

They are throwing caution to the wind with this amended policy. By ditching the clear list of eligible projects—like factories or warehouses—it opens the door to all sorts of ventures, maybe even apartment buildings or hotels, getting tax breaks. That’s too risky for taxpayer dollars. It could overload our roads and schools, siphon money from vital services, and put our county’s financial health in jeopardy. For these reasons, I opposed this amendment on the record. Amended Tax Abatement Policy passed 4-1.

FY2026 BUDGET WORKSHOP

20. Consider and discuss FY2026 Budget requests and take necessary action regarding the same.

Comments:

If you have made it this far you know this was a long meeting. The Budget Workshop portion began after lunch. Rather than writing a report the size of a Tolkien novel to explain, I want to offer what I took away as priorities that should be explored in the budget and ask for feedback from you, my constituents. I work for you and could use your input on where you want your tax dollars to go.

Ronald Reagan said, “No new taxes,” and I agree at the county level. The county has enough money in the budget to cover key needs—we just need to shift it around wisely. Cutting spending is always the goal. As one vote, I need partners ready to trim even more waste than the Budget Officer suggests. The appetite for DOGE-ing County Government seems to be an acquired taste.

Let’s Look at the Past

The FY24 financial audit revealed $10.2 million in unspent funds due to overestimated department budgets. It can also be interpreted as over-taxation. Departments often inflate their budgets for “just in case” scenarios, but when the money goes unused, it’s transferred to the Unrestricted Fund, commonly known as the Rainy-Day Fund. The total in the fund was $56 Million.

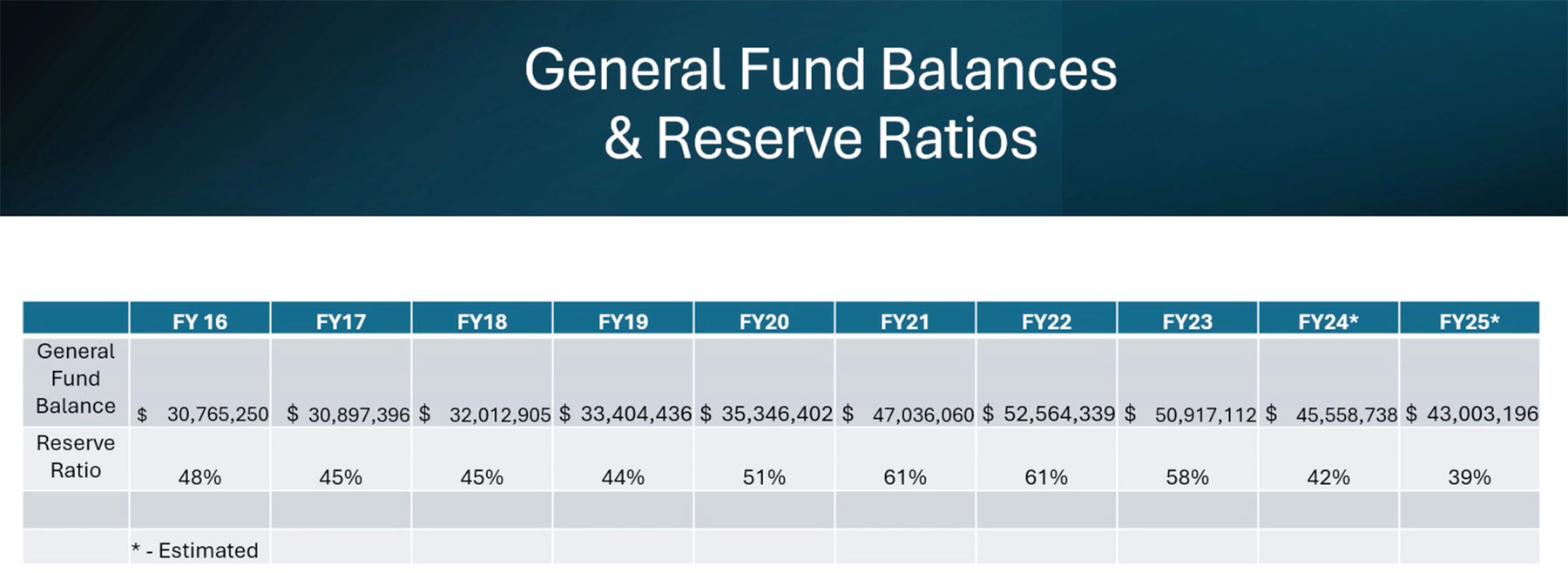

Just like you plan for emergencies in your home finances, it is a good financial practice for your county government to maintain a reserve fund. The Government Finance Officers Association (GFOA) recommends a minimum of 16.7% (two months) of operating expenditures, but Smith County’s 25% policy (set in 2017) exceeds this, reflecting a conservative approach to handle risks like natural disasters or revenue volatility. The audit revealed a Reserve Ratio for FY24 of 57.9%.

Comments:

How the Rainy Day Fund Can and Cannot Be Used

The county’s Rainy-Day Fund, totaling $10.2 million within the Unrestricted Fund, functions like a savings account for one-time needs rather than ongoing expenses. It cannot be used to fund new, sustained programs or salaries, as these require stable revenue that may not be available in future years, potentially leading to tax increases. Instead, it’s reserved for emergencies or one-time costs, such as:

- One-Time Purchases: Major capital expenses like new equipment or building repairs.

- One-Time Transfers: Single payments to boost funds like the Healthcare Fund.

- Debt Reduction: Paying down certain debts, though not always bonds due to specific repayment rules.

For the FY26 budget, departments and elected officials requested $10.5 million for new expenses. If budgets had been based solely on actual needs—potentially through Zero-Based Budgeting, where every dollar is justified from scratch—the remaining $10.2 million could have nearly covered these requests without tax hikes. However, this surplus is currently “frozen” for one-time uses to protect taxpayers from future shortfalls, highlighting the importance of careful planning over funding every wish.

How Can We Meet Budget Needs Without Raising Taxes?

To fund the county’s needs responsibly, we must cut wasteful spending and make smart choices with the money we have:

- Trim Wasteful Spending: Review each department’s end-of-year budget leftovers and current spending trends. Work with elected officials and department heads to cut unnecessary expenses. Move those savings to where they’re needed most but say no to anything that requires a tax hike.

- Use Special State Funds: Some county departments have access to special funds from the state—tax dollars you’ve already paid that are returned as supplemental funding. Many of these funds sit unused. Those funds offset the tax burden on the citizens.

- Focus on Spending, Not Revenue: Our problem isn’t a lack of money—it’s how we spend it. Let’s sharpen our pencils, use a big pink eraser, and dig into budget stashes to fund only what’s essential for serving Smith County citizens.

The High Cost of Employee Turnover:

Every time a County employee leaves, your tax dollars are squandered. Replacing them incurs significant costs, including mandatory technology onboarding for all new hires. Depending on the department, additional expenses may include uniforms, equipment, weapons, specialized training, or even vehicles. Some of these costs are lost entirely when an employee leaves.

Examples of Estimated Costs of Replacing a Single Employee:

- District Clerk: $15,700

- Facility Services: $16,100

- Law Enforcement: $40,000

Since January 1st, the County has lost 88 employees. At an average replacement cost of $16,000 per employee, that’s $1,408,000 in wasted tax dollars. New hires restart this costly cycle. Without urgent action to improve employee retention, these losses will continue to empty your pockets. We must prioritize keeping our workforce to protect your money.

After reviewing the initial presentations from the Department Heads, I am sharing my proposed priorities for consideration, contingent on the availability of funds for reallocation. Please take a moment to review this list, and I welcome any feedback you may have.

Information Technology:

Staffing requests & scale adjustments – Technology is advancing rapidly, and as county staff grows, the demand for IT personnel rises accordingly. Cutting corners on the IT department could shut down county services. IT is critical to county functions, but our IT team is stretched thin and needs skilled people. We have to be smart with money, but we can’t skimp on IT staff or equipment to keep things working.

- Additional Staffing; Network Administrator, Data Architect, Tech Support Analyst, Business Analyst: $496,138

- Increase to pay for IT Admin Support Step 3: $4400

- Critical issue; must find this funding within the budget

Animal Control:

Last year, a new animal control facility was added to the Capital Improvement Plan using ARPA funds. However, providing this service and facility is not a constitutional obligation. Once a past Commissioners Court approved funding for this department, it opened a Pandora’s box of costs, and we must prioritize taxpayer dollars when planning for the future. If Smith County commits to running a shelter, we must do it right. This means offering competitive salaries to attract and retain qualified staff, as these roles face intense public scrutiny, making them less appealing. Additionally, investing in measures to curb the stray animal population—such as spay and neuter programs—will reduce future workloads and save taxpayer money in the long run.

- Increase in Animal Medical for the purpose of spay and neutering the animals – $32,500

- Reduces the citation workload

- Reduces the future puppy population

- Animal Control Officers – salary scale adjustment

- ACO 1: Current pay is about $19/hr. Request is $22/hr.

- 4 Trained Officers -1 has a Jailer Certification

- If $22/hr is approved, estimated yearly increase (for all 4 officers total)=$26,000

- Kennel Tech – salary scale adjustment

- Pay is $15.38/hr (or $31,200). Request is $17/hr (or $35,360)

- 4 positions (I believe there are 2 open positions currently.)

- If $17/hr is approved, estimated yearly increase (for all 4 techs total)=$15,000

- Animal Control Director – salary adjustment

- Current Pay: Step 1 is $52,510; Step 2 is $57,371; Step 3 is $61,331

- Requested Pay: Step 1 is $80,500; Step 2 is $81,700; Step 3 is $83,200

- Estimated Annual Cost of Increase: Step 1: $30,886; Step 2: $26,847; Step 3 is $24,132

- This is the lowest paid of all the “Manager” positions. The next highest salary is Records Manager, then Law Librarian, then Compliance Officer and Director of Communications. This Director manages 8 employees. This role requires expertise in animal care, law enforcement knowledge, leadership skills, and the ability to navigate emotionally charged situations involving animals and the public.

- Recommendations for cost savings:

- Jailer Certification CE credits need to be obtained when SO hosts free classes

- Utilize Online Training to reduce the $10,000 Training Expense line

- Estimated $40,000 reduction in fund lines

- Potentially a $97,632 increase – $40,000 in reallocated funds within this budget = Need to find at least $60,000 to fund these requests.

Constables:

Smith County’s Constables are dedicated public servants who exceed expectations in serving our communities, embodying the county’s motto, Striving for Excellence. The proposed pay increase from $82,032 to $95,000 for all five Constables (totaling $64,840) and $5,000 stipends for chief deputies are reasonable, necessary, and fiscally responsible measures to maintain a high-performing team, ensure operational continuity, and align with competitive standards.

Smith County’s Constable salaries are significantly lower than those in counties of similar size and population. Comparable counties offer salaries averaging 10-15% higher for similar roles. A modest increase to $95,000 ensures Smith County remains competitive, preventing the loss of our skilled Constables to other jurisdictions.

Constables must serve the constituents who elect them in a manner that meets their expectations. Although some may assume Constables only serve civil papers and act as bailiffs for the Justice of the Peace courts, that perception is outdated. Today’s Constables go far beyond these traditional duties, providing exceptional service that strengthens public trust and upholds the highest standards of professionalism. Fair and competitive compensation signals the county’s commitment to valuing employees who meet and surpass these expectations, supporting stability and confidence in the Constable’s Office.

Smith County’s Constable’s Offices have overcome a dark past, instability and intense public scrutiny. The current team operates at a high level, working collaboratively to provide reliable service to taxpayers. They provide support to multiple agencies within Smith County. The Constables’ role is a combination of multiple roles within law enforcement but under 1 title. Whether you are a Firefighter, EMS, Animal Control, Sheriff’s Deputy, School Police, DPS or a Game Warden, our Constables are sometimes the only law enforcement officers that can be your backup.

Chief Deputies step into the Constable’s role during absences, ensuring uninterrupted operations. Their cross-training is critical for emergency preparedness and operational resilience. Unlike the Sheriff’s Office, the Constable’s Office lacks a rank-based pay structure or supplemental pay for deputies. A $5,000 stipend is a flexible, cost-effective alternative to a full pay scale overhaul, incentivizing performance without long-term financial burdens.

The $64,840 total increase and $25,000 in stipends for all 5 Chief Deputies are funded through reallocation of the Constables’ collective budgets, and they could choose to supplement some additional funding requests with LEOSE (Law Enforcement Officer Standards and Education) funds. This approach would avoid new tax burdens.

Fire Marshal:

Staffing increases for cost-saving roles:

Recovery & Mitigation Specialist – This role helps our county save money and be better prepared for natural and man-made emergencies. After a disaster, this person works to get money back from the government to cover costs, so taxpayers don’t carry the full burden. During “Blue Skies”, non-emergency times, they apply for grants to get supplemental funding for things like equipment and supplies our Office of Emergency Management needs.

Currently, we can’t afford to keep a lot of expensive emergency supplies just sitting around, and it’s hard to justify that cost to you, the taxpayer. This specialist will find grants to slowly build up our resources over the next 5-10 years, so we’re ready for a large-scale disaster without raising your taxes. This job pays for itself by saving money and making our county stronger.

Community Engagement Liaison – This role helps our county prepare for emergencies by working with neighbors to help each other. Since our Office of Emergency Management doesn’t have a big budget and we can’t afford or justify spending millions on supplies for a disaster that we can’t predict, this person will teach residents how to prepare and support one another. This saves money and reduces the pressure on the county during a crisis.

By training people to be their own first responders, like through programs such as CERT, this role helps save lives and protects our county’s resources. It also keeps our community’s trust by showing we’re working together. Networking with community partners for response will be extremely helpful during this time when we are not fully equipped with resources and supplies for emergency response. The liaison will need to attend/host evening meetings and some weekend events to connect with people, as community engagement doesn’t work with just regular 9-5 hours. This job strengthens our community, saves tax dollars, and helps us all be ready for emergencies.

Year 1 Request for Mass Casualty Trailer Supplies – $25,000

Our county needs basic supplies to respond to emergencies like storms, but our Office of Emergency Management doesn’t have a big budget. We can use a small amount of money from the county’s extra funds (Unrestricted Fund/Surplus) to buy equipment and storage for these supplies. Right now, there’s no space left at the Emergency Operations Center (EOC), and the Emergency Management Coordinator’s office is being used as a storage room. This is a small, one-time purchase that will help us be ready for emergencies without costing taxpayers a lot. The supplies can also be used for different types of emergencies.

Recommendations:

- Use $15,000 originally planned for a part-time position in FY 25, which wasn’t used, and reallocate it in the FY 26 budget.

- Use as much online training available this year to save money on conference costs.

- Check with our Road and Bridge Sign Shop to make road signs instead of buying them.

- Overall -$52,000 in budget reductions to help pay for these needs.

This plan is a low-cost way to get essential supplies, save money, and make sure our county is better prepared for emergencies.

Facilities Services:

Our Facilities Services Department had over $1 million left in its budget at the end of FY 24. Some of this money might have been set aside for planned projects, and it’s not necessarily the Facilities Director’s fault for having this surplus. His budget covers every construction and maintenance project for county buildings.

Staffing Needs for the New Courthouse

We need to plan for additional staff to maintain the new courthouse, which is set to open in November 2026 if everything stays on schedule. The county has a legal duty to keep our buildings in good shape, but right now, our performance is only average, and the core divisions are understaffed. This has been an issue for a couple of years. With the new courthouse coming, we need to hire more staff to keep all county buildings clean and maintained—cutting back on cleaning other buildings isn’t a good option.

The proposed cost for new staff (salaries and benefits) is $885,000. We need to review the FY 24 leftover funds and see if we can reallocate money within his existing budget to cover these new positions without needing extra taxpayer funds. Some projects may need to be postponed until FY27.

In closing, these early budget priorities aim to strike a balance between protecting your hard-earned tax dollars and addressing some pressing needs of county departments that serve you. This is just the first round—nothing is set in stone. More presentations are coming, and I’m committed to listening closely and adjusting priorities as needed. But here’s the bottom line: it’s your money, and your input is crucial. I want to hear from you so together we can make smart, responsible choices that keep Smith County’s budget working for you—efficiently and fairly. Hope to see you at the Town Hall on July 27. Bring a friend and let’s talk about this!