Commissioners Court Notes

Please note: All agenda items are considered PASSED unless indicated otherwise.

OPEN SESSION:

PRESENTATIONS

1. Receive presentations from Opioid Grant applicants.

Watch the presentations and share your thoughts with me!

Comments:

On Tuesday, eight local organizations presented to the Commissioners Court during an open public workshop. Each gave a detailed pitch explaining:

- How much of the $300,000 opioid settlement grant they are requesting

- Exactly how they would use the money to provide treatment, recovery support, or prevention services

The presentations were recorded, and I’ve clipped just that portion of the meeting and linked it in the video box above.

I’d appreciate your help reviewing these eight pitches. Before the Court makes final funding decisions, members of the public (and the Court itself) are encouraged to watch and submit feedback.

Since this is a reimbursement-only program, any contracts we award will require providers to pay upfront for approved services and then submit documentation for repayment—so the strength of each organization’s plan, track record, and ability to meet reporting requirements really matters.

Once you’ve had a chance to watch, let me know your thoughts on which organizations should be prioritized and why. That will help us decide how to allocate the $300,000 fairly and effectively. Thank you!

2. Receive update regarding Pine Bliss, LLC and Redtown Ranch Holdings, LLC well permit applications with the Neches & Trinity Valley Groundwater Conservation District.

Comments:

The permits have been suspended temporarily. We are awaiting the outcome of an attempted intervention by Pine Bliss and Redtown Ranch in litigation pending in Anderson County. This will determine our next steps. Our outside counsel continues to monitor the situation and is working to ensure that the water resources of the citizens of Smith County and the surrounding areas are protected.

COURT ORDERS

COMMISSIONERS COURT

3. Consider and take necessary action to accept and approve the 2023-2025 Smith County Sexual Assault Response Team Biennial Summary.

Comments:

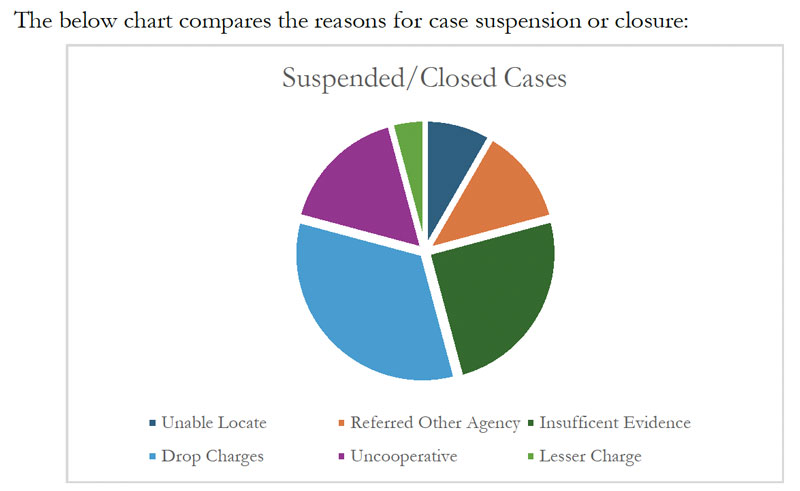

The 2025 Biennial Report from the Smith County Sexual Assault Response Team (SART) provides an overview of the team’s efforts to support survivors of adult sexual assault through collaboration among local agencies, including law enforcement, prosecutors, advocates, and medical professionals. Established in 2021 under Texas Senate Bill 476, the SART focuses on trauma-informed services, evidence collection, and improving community responses to sexual violence. The report covers activities from November 2023 to October 2025, highlighting data trends, cross-trainings, and ongoing challenges like obtaining survivor consent for case reviews, while emphasizing successes in inter-agency cooperation and data collection.

Key points:

- Tyler PD and the Smith County Sheriff’s Office together received 170 reports of adult sexual assault (95 to Tyler PD, 75 to Sheriff’s Office)

- 27 cases involved date-rape allegations (up from the last report)

- About half of closed cases stopped because victims chose not to continue or there wasn’t enough evidence to move forward

- 8 new cases were presented to the District Attorney’s Office; 5 were indicted and 4have already resulted in plea deals

- East Texas Crisis Center served 95 survivors in 2025 (through October) and accompanied 70 hospital exams

- The team held trainings on legal aid, victim compensation, DNA evidence, and human trafficking resources

- SART continues to strengthen coordination among law enforcement, prosecutors, advocates, and medical providers to better support survivors and hold offenders accountable

Overall, reports stayed steady, more cases are reaching prosecution, and the team is working hard to make the system more survivor-centered and effective.

4. Consider and take necessary action to approve the two-year bond renewal for Smith County Fire Marshal, Preston Chad Hogue, effective December 13, 2025, and authorize the county judge to sign all related documentation.

Comments:

We approved the renewal of the Fire Marshal’s bond for another 2 years.

TAX OFFICE

5. Consider and take necessary action to approve the 2025 Tax Roll pursuant to Sec. 26.09(e) of the Tax Code and authorize the county judge to sign all related documentation.

Comments:

Every year, the county has to officially approve the final property tax roll – the big list of how much every property in Smith County is worth and how much tax is owed on it. This is required by state law.

What You Need To Know:

- Property values aren’t set in stone. When the Appraisal District first “certified” the values in July 2025, the total taxable value of all property in Smith County was about $31.89 billion. By October, after thousands of protests, lawsuits, new homestead exemptions (especially the new $100k–$140k ones voters just approved), and other corrections, the total taxable value dropped by about $158 million to $31.74 billion.

- That drop means a little less tax money coming in. Because some properties are now worth less on paper (or are getting bigger exemptions), the county will collect roughly $300,000–$520,000 less in property taxes than originally expected. The county auditor said they already planned for this possibility when they made the budget and were very conservative.

- But there’s some good news too! The Appraisal District hired the Linebarger Law Firm to audit homestead exemptions. They’ve already found people who were wrongly claiming homesteads (or forgot to tell the county when the homeowner died), and so far that’s adding back about $417,000 in taxes, with more audits still in progress. That helps offset some of the loss.

- We approved the updated (slightly lower) 2025 tax roll showing a total tax levy (the amount billed to all property owners combined) of $105,917,115.81.

CONSTABLE – PCT 5

6. Consider and take necessary action to approve the 2026 Federal Equitable Sharing Agreement and Certification for Smith County Constable, Precinct 5, and authorize the county judge to sign all related documentation.

Comments:

The Smith County Constable Precinct 5 has a special federal bank account for money they get from helping federal agents seize cash or property from criminals (mostly drug cases).

- Start of the year: $16,963.45

- Earned $763.30 in bank interest

- Current balance: $17,726.75

That $17,727 is all the federal seizure money the office has right now. Every year they file the “2026 Equitable Sharing Agreement” report promising to use it only for allowed law-enforcement items (ex. equipment, training, etc.) — never for regular salaries or bills.

RECURRING BUSINESS

ROAD AND BRIDGE

7. Consider and take necessary action to authorize the county judge to sign the:

a. Final Plat for the Hernandez Addition, Precinct 2,

b. Re-Plat for the Cherry Creek Addition, Lots 1, 2 and 6, Precinct 3; and

c. Re-Plat for the Tristan’s View Subdivision, Lots 6-8, Precinct 3.

AUDITOR’S OFFICE

8. Consider and take necessary action to approve and/or ratify payment of accounts, bills, payroll, transfer of funds, amendments, and health claims.

ADJOURN